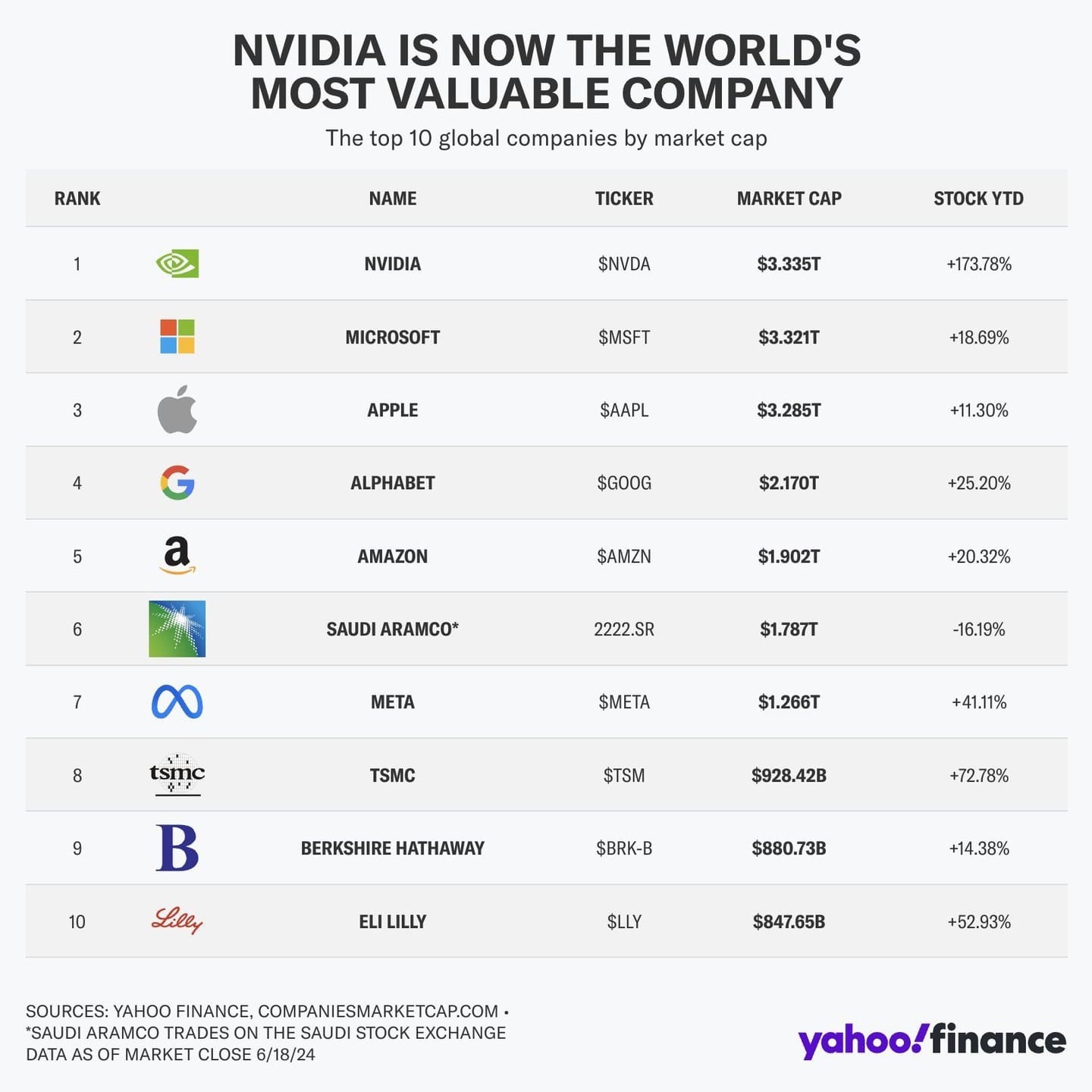

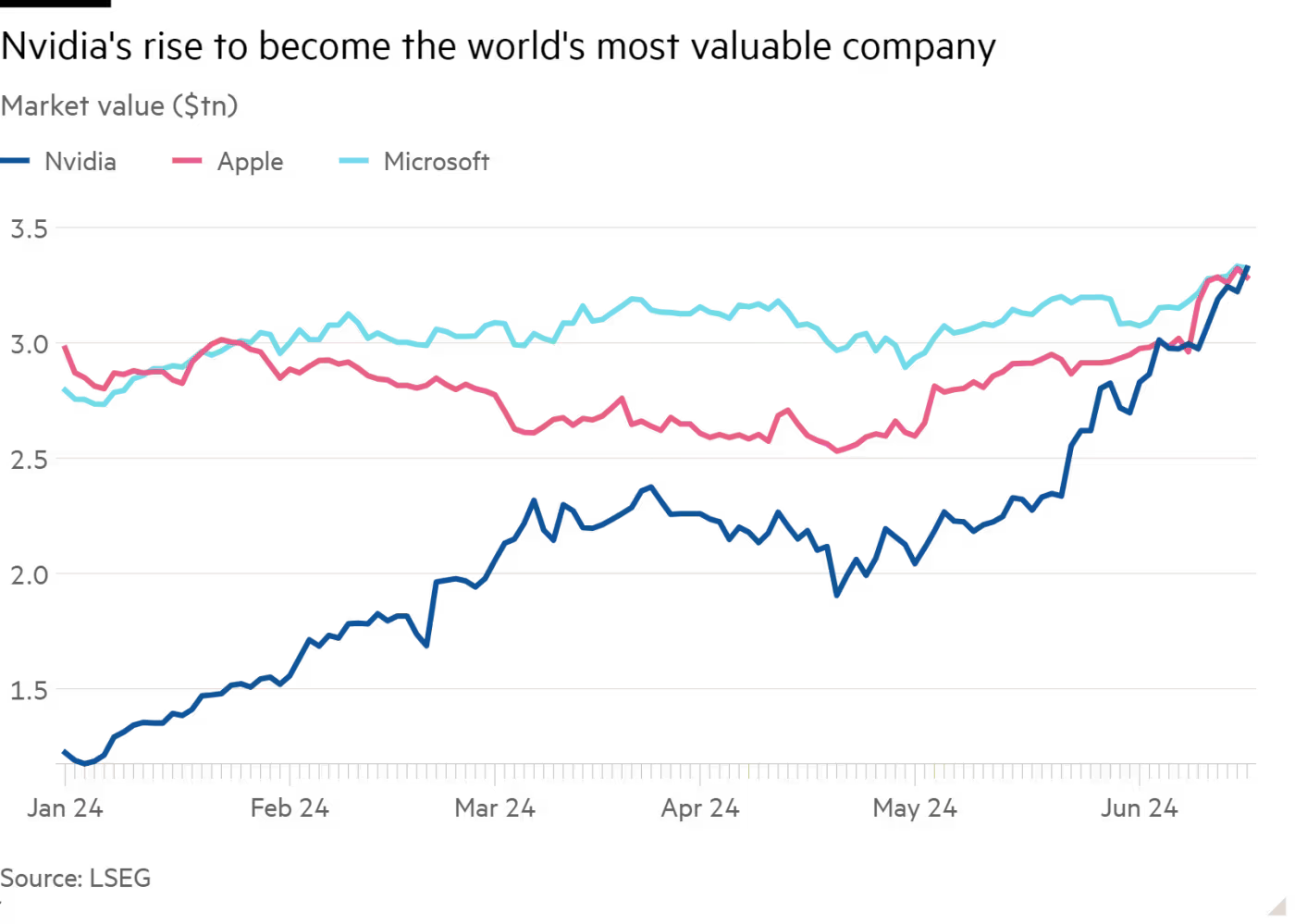

On Tuesday, NVIDIA surpassed Apple and Microsoft to become the most valuable company in the world with a market cap of $3.34 trillion.

But, that number alone does not do this historial moment justice. Here are 15 fascinating statistics that put NVIDIA's remarkable rise to the top in perspective:

1. April 5, 1993

NVIDIA was founded 31 years ago on April 5, 1993, by Jensen Huang, Chris Malachowsky, and Curtis Priem. This was nearly 20 years after Microsoft (1975) and Apple (1976) were founded. That year, General Electric was the most valuable company in the world by market cap at $87.71 billion.

2. It's a Flop

NVIDIA nearly went bankrupt three times between 1993 and 1997. Their first chip, the NV1, developed in 1995, failed. They scrapped plans for their second chip, the NV2, midway through development. Huang famously said, “We’re only 30 days from going out of business.”

3. The First GPU

In 1999 (25 year ago), NVIDIA invented the world's first GPU, the GeForce 256 based on the NV10 chip. The GPU sparked the growth of the PC gaming market and set the stage for the company's future success. Today, GPUs power some of the world's most important technologies like robotics, VR, crypto, and AI.

4. The CUDA Advantage

In 2006, NVIDIA invented CUDA. It allows developers to take advantage of the parallel processing capabilities of NVIDIA GPUs for non-graphics tasks. This helped to create a powerful network effect, making CUDA the go-to platform for developers in AI and GPU acceleration. CUDA has been embraced by over 4 million developers, and downloaded over 40 million times.

5. $6.9 Billion Acquisition

On March 11, 2019 NVIDIA (valued at $93 billion) acquired Mellanox for $6.9 billion—outbidding Intel and other suitors in the process. This is NVIDIA's largest acquisition to date. Mellonox's networking and technology stack has been integral to helping NVIDIA deliver the high performance computing architecture that datacenters need today.

6. Insatiable GPU Demand

Demand for NVIDIA's high-performance AI GPUs has been off the charts. For example, six months ago, lead times reached 11 months—meaning customers had to wait almost a year to have their GPU orders fulfilled. Now, the lead time has dropped to just 2-3 months. Tech giants are trying at acquire as much as they can. Earlier this year, Meta CEO Mark Zuckerberg said that they would be buying 350,000 H100s this year. This month, Elon Musk hinted at acquiring 300,000 B200s for xAI next summer.

7. Five Years Ago...

5 years ago, today, on June 17, 2019, NVIDIA's marketcap was $88.32 billion. Apple's was 892.10 billion and Microsoft's was $1.018 trillion. Since then, Microsoft's marketshare has increased 3.3X, Apple's by 3.7X, and NVIDIA by 38X.

8. The Arm Deal that Wasn't

In 2020, NVIDIA announced they would be acquiring Arm for $40 billion. Under the terms of the transaction, NVIDIA was to pay SoftBank a total aggregate amount of $12bn in cash and $21.5bn in NVIDIA shares. Arm employees would also have been issued $1.5 billion in NVIDIA equity. The deal eventually fell through due to regulatory pressure and Arm went public instead. Softbank's 443 million shares that it would've received in NVIDIA would be worth over $60 billion today.

9. What's 3% Worth?

As NVIDIA's CEO, for FY25, Huang's total compensation is about $44M. Tim Cook's (CEO of Apple) was $63M in 2023 and Satya Nadella (CEO of Microsoft) was $48.5M. However, Huang owns 3% of NVIDIA. That means that on any given day, he can gain (or lose) more than his total compensation for the year.

10. Huang's Rising Net Worth

Five years ago, Huang was worth an estimated $4 billion (546th richest person on Forbes’ World Billionaires list). He started this year (2024) with a net worth of $77 billion. Today, he became the 11th-richest person in the world with an estimated net worth of $119 billion. His net worth increased by $4 billion today alone.

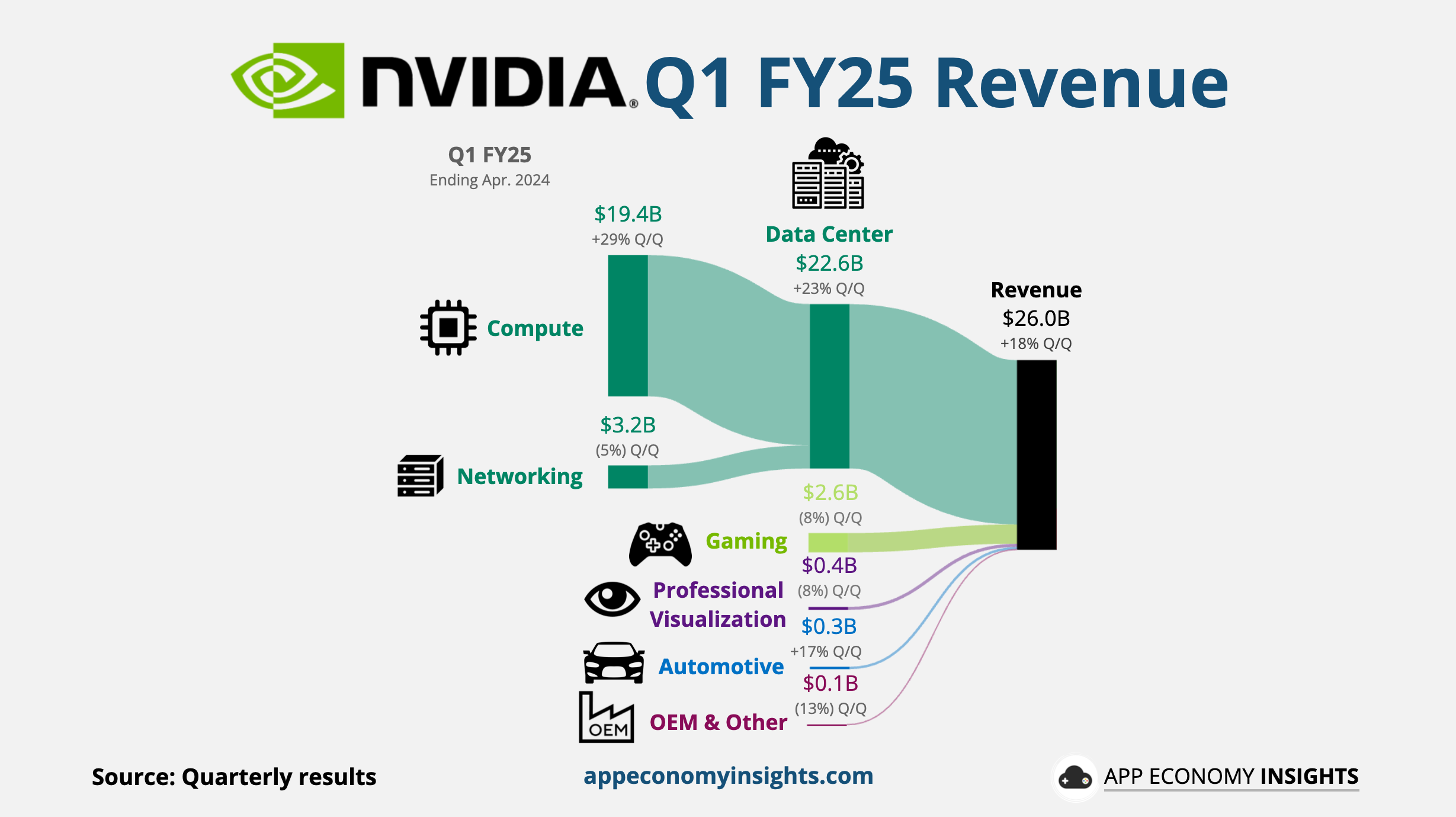

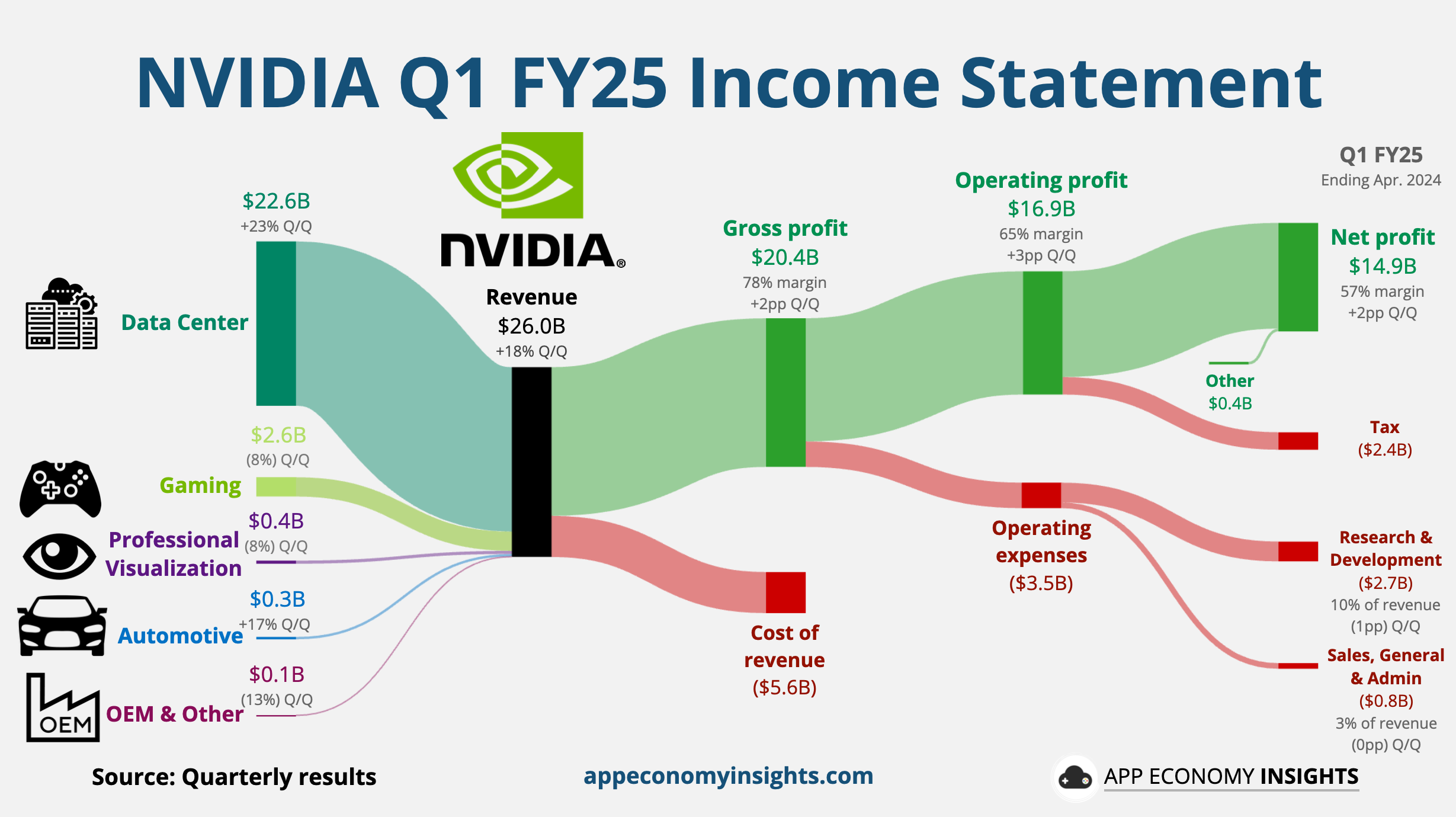

11. 95% of Data Centers

It's important to appreciate NVIDIA's absolute dominance in data centers. NVIDIA has over 95% market share of data center GPUs and about 80% market share if you're just talking AI accelerators. In Q1 FY25, the 'Data Center' category accounted for 87% of overall revenue—up 427% year-over-year.

12. What about Revenue?

In Q1 FY25, NVIDIA reported revenue of $26 billion with 20.4 billion gross profit. In that same period, Microsoft reported $61.9 billion in revenue with $43.4 billion in gross profit. Apple reported $90.8 billion in revenue and $42.3 billion in gross profit.

13. In Just 110 Days

It took NVIDIA 30 years to get to $1 trillion market cap.…then 10 months to double to $2 trillion.… and now, just 110 days later, they’re at $3.3 trillion.

14. If you invested $1000...

If you invested $1000 in NVIDIA, here's how much it would be worth as of today, June 18, 2024:

- IPO (January 22, 1999), would now be $3.03M

- 10 years ago (June 18, 2014), would now be $288,977.33

- 5 years ago (June 18, 2019), would now be $35,455.24

- 1 year ago (June 18, 2023), would now be $3,076.73

15. Where are they now?

So, what happened to NVIDIA co-founders Curtis Priem and Chris Malachowsky? Priem, who was NVIDIA's first CTO, had the same number of stocks as Huang when NVIDIA went public in 1999. He left the company in 2003. He donated more than 75% of his stocks (about 1 billion in today's share count) to a charity and sold the remainder by 2007. Had he held onto his stock, he could have been a centibillionaire.

Chris Malachowsky, who was the former VP of Engineering, is now considered an 'NVIDIA Fellow'. While not as active as Huang, he still serves as a member of the executive staff and a senior technology executive for the company. He has been a major donor to his alma mater, the University of Florida. Malachowsky hasn't been required to disclose his NVIDIA sales or holdings since 2002. If he still held the same number of shares as he did then, it would be equivalent to 7 billion shares today (adjusted for stock splits).

NVIDIA's rise to the top is a remarkable story of innovation, resilience, and strategic decision-making. As AI continues to rapidly transform industries and shape our future, their impact is undeniable. It will be fascinating to see how the company continues to evolve and impact the world in the years to come.