Cathie Wood's Ark Investment Management has announced that her firm has acquired a stake in OpenAI. The investment, made through Ark's $54 million venture fund (ARKVX), positions OpenAI as a key holding, accounting for approximately 4% of the fund's total assets.

In an email to clients on Thursday, Ark said, “As of April 10, 2024, the Ark Venture Fund invests in OpenAI...[the company] is at the forefront of a Cambrian explosion in artificial intelligence capability.”

The decision to invest in OpenAI comes as no surprise, given Ark's reputation for identifying and backing disruptive technologies. As Ark Chief Futurist Brett Winton explained in an interview, "OpenAI is at the forefront of a Cambrian explosion in artificial intelligence capability." He added, "We think that there's $16 trillion in prospective market cap that will be commanded by foundation model-type companies by 2030."

OpenAI has raised significant funding, with Microsoft investing $13 billion. The company recently allowed employees to sell shares via a tender offer, valuing the company at $86 billion.

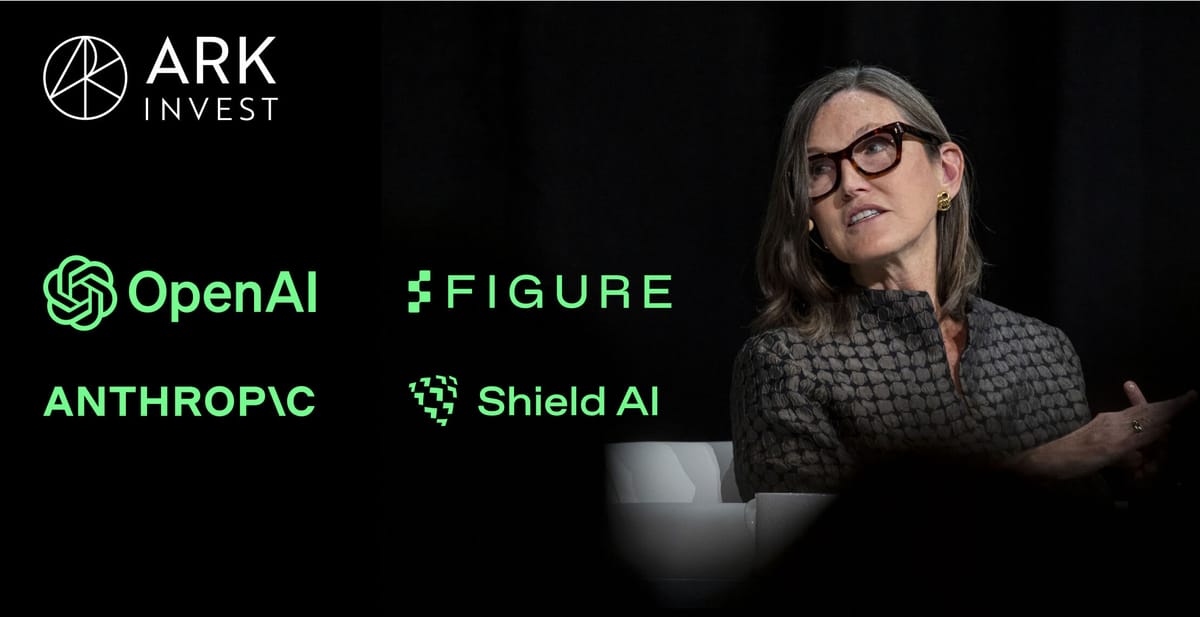

Ark's investment in OpenAI is not its only foray into the AI space. The venture fund also holds a stake in Anthropic (which accounts for 5% of ARKVX), Shield AI, and Figure AI. This diversification strategy shows Ark's desire to capturing the immense potential of AI across multiple companies and approaches.

The rapid pace of innovation in AI has been a driving force behind Ark's decision to invest. "The incremental progress in the foundation model space has been quicker than even we had anticipated," Winton remarked. He specifically highlighted OpenAI's recent release of Sora, a text-to-video generative AI tool, calling it "mind-blowing."