Tax season just got a bit easier for the millions of Americans who prefer to file their own returns. H&R Block today announced the launch of AI Tax Assist, a new tool leveraging artificial intelligence to provide personalized guidance and support throughout the tax preparation process.

Designed for DIY filers, AI Tax Assist combines H&R Block's 70 years of tax expertise with Microsoft's latest Azure OpenAI capabilities. The goal is to simplify and streamline tax prep for individuals, sole proprietors, and small business owners.

"Filing taxes can be confusing and stressful. With AI Tax Assist, we can now leverage AI to provide customers unlimited tax advice whenever they need it," said Heather Watts, SVP of Consumer Tax Products at H&R Block. "By pairing our unparalleled tax knowledge with leading AI technology, we've created a tax prep experience that is truly intelligent and empowering."

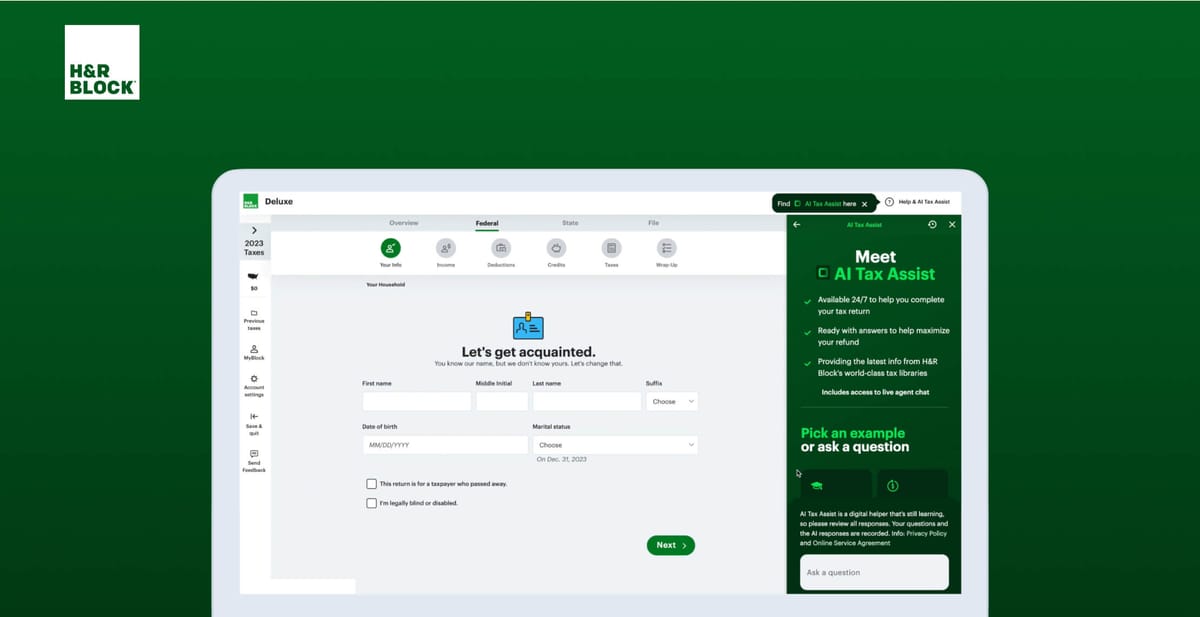

The AI Tax Assist interface allows users to ask tax-related questions conversationally, with the AI responding in real-time with clarification, definitions of key terms, explanations of forms and deductions, and guidance based on the latest tax codes.

Unlike some consumer AI tools, AI Tax Assist is focused squarely on tax compliance, ensuring users follow IRS rules and maximize returns. And if customers want to consult a live preparer, H&R Block tax pros are available at no additional cost.

H&R Block states that between the AI and access to human experts, DIY filers can prep taxes with total confidence, backed by the company's accuracy and maximum refund guarantees.

In addition to AI guidance for all users, H&R Block offers four online tax prep product tiers – Basic, Deluxe, Premium, and Self-Employed – with pricing tailored to filers' unique tax situations.

The Free edition covers simple returns, while Deluxe adds support for homeowners and those with dependents. Premium provides tools for investments, rental income, and other complex finances, and the Self-Employed product offers specific help for independent contractors and small business owners.

While H&R Block sees 70-80 million DIY filers each year, consumer tax software has seen only incremental innovation recently. By taking advantage of AI, H&R Block aims to set a new standard for simplifying and demystifying tax preparation.

And with Americans leaving over $1 billion in unclaimed refunds on the table each tax season, a reliable DIY tool like AI Tax Assist could help more households get the tax outcomes they deserve – key to H&R Block's goal of providing financial confidence through taxes.