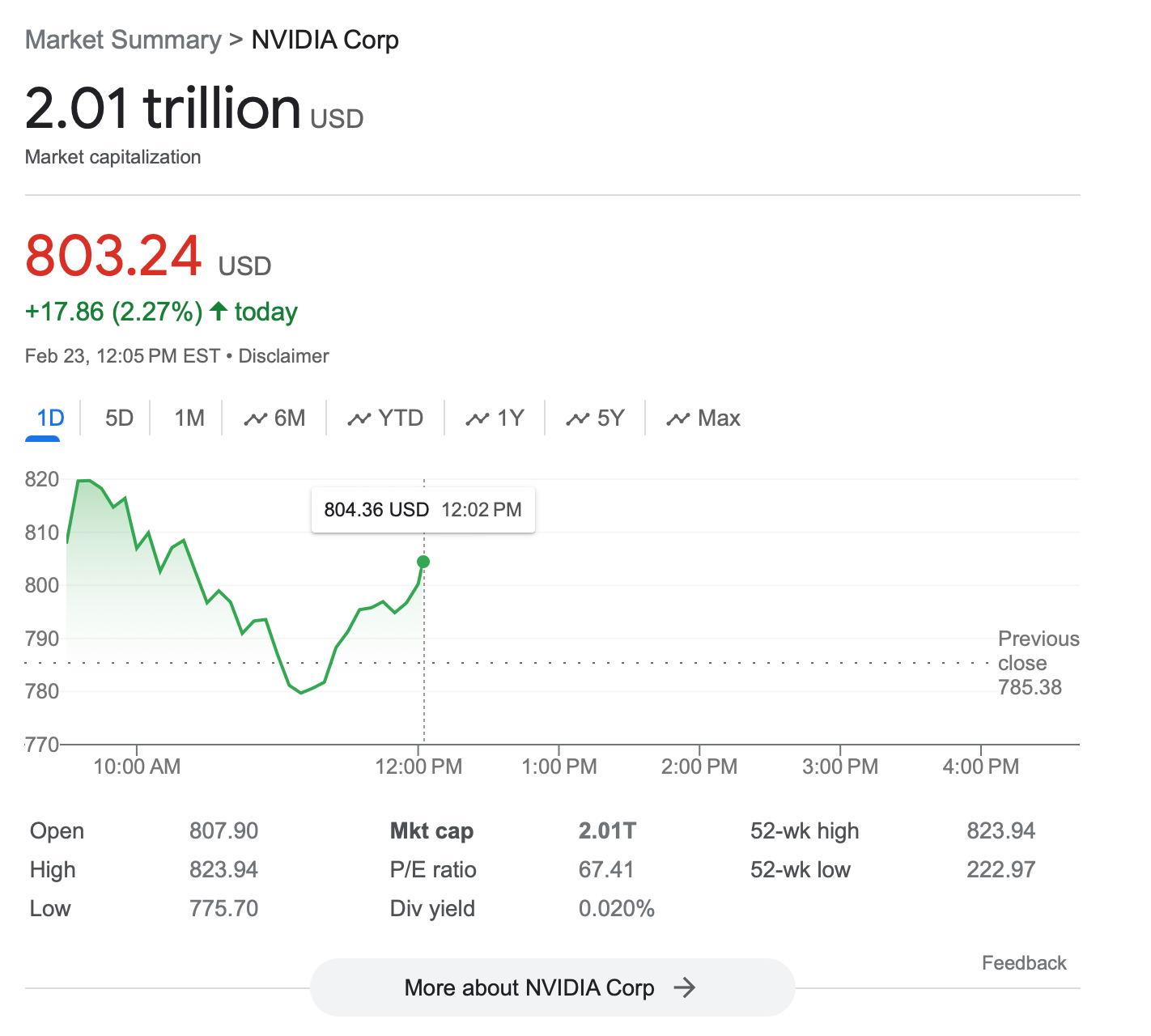

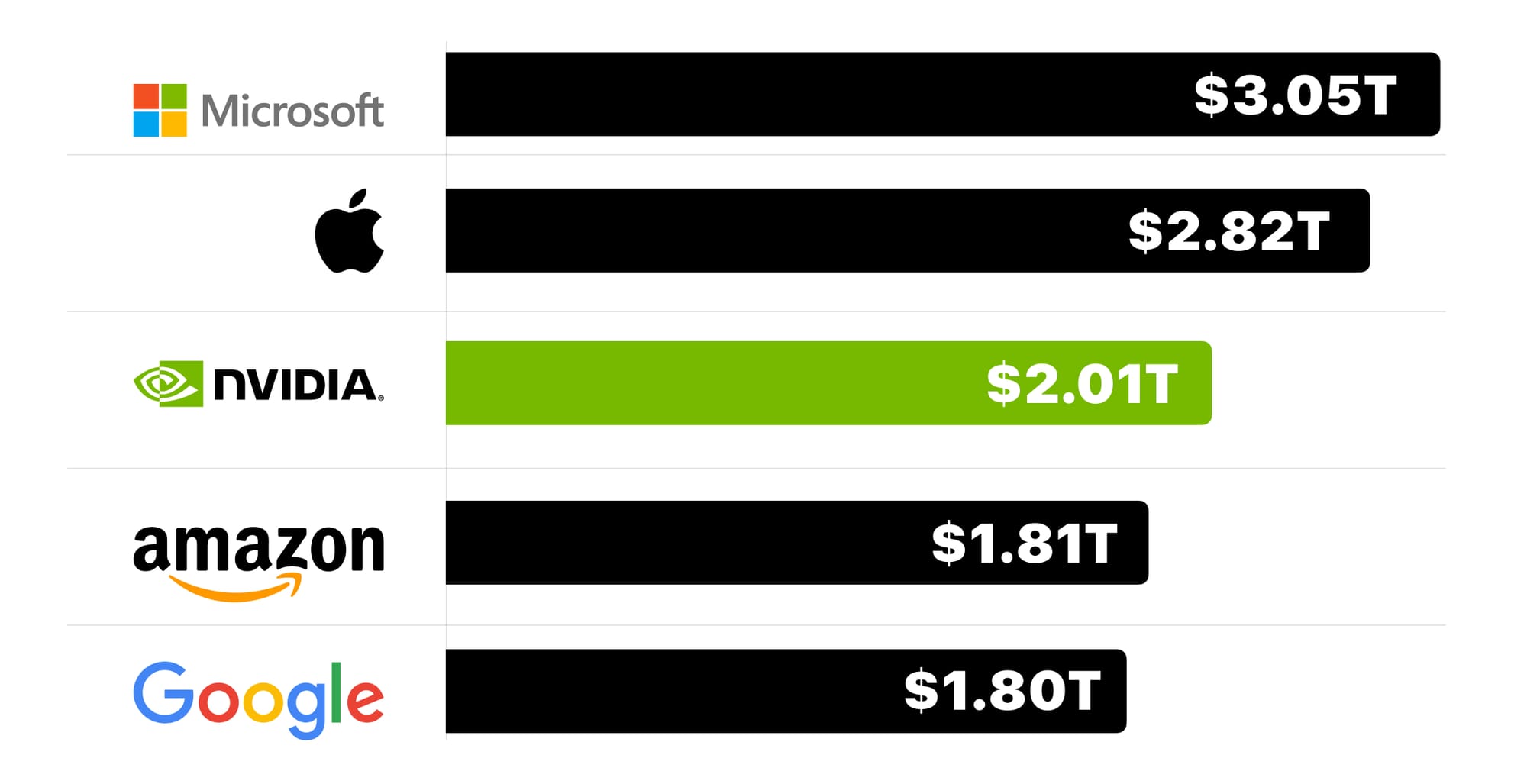

Graphics chipmaker NVIDIA made history on Friday by becoming the third U.S. company to reach a $2 trillion market valuation. Buoyed by strong quarterly earnings and insatiable demand for its graphics processing units (GPUs) that power generative AI models, NVIDIA's now joins an exclusive company with Apple and Microsoft.

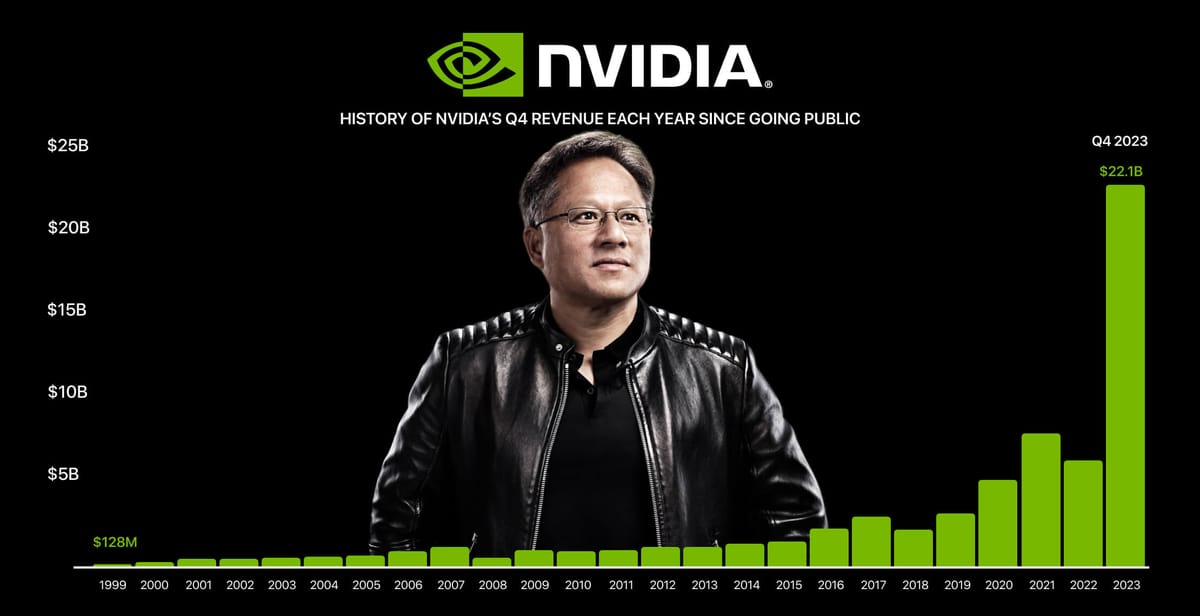

NVIDIA's share price rose to an all-time high of $823 on Friday, capping a meteoric 67% year-to-date rally. This builds on massive 2023 gains, when shares more than doubled. Needless to say, investors are betting big on NVIDIA's central role in the AI revolution. The company dominates the GPU market, with its high-performance chips perfectly suited for AI workloads like training complex large language models.

Demand drastically outpaces supply, even with NVIDIA's state-of-the-art manufacturing capacity. “A whole new industry is being formed, and that’s driving our growth,” said NVIDIA CEO and co-founder Jensen Huang. He believes the rise of generative AI will fuel trillions in spending and double the number of data centers within five years—presenting a massive opportunity for NVIDIA.

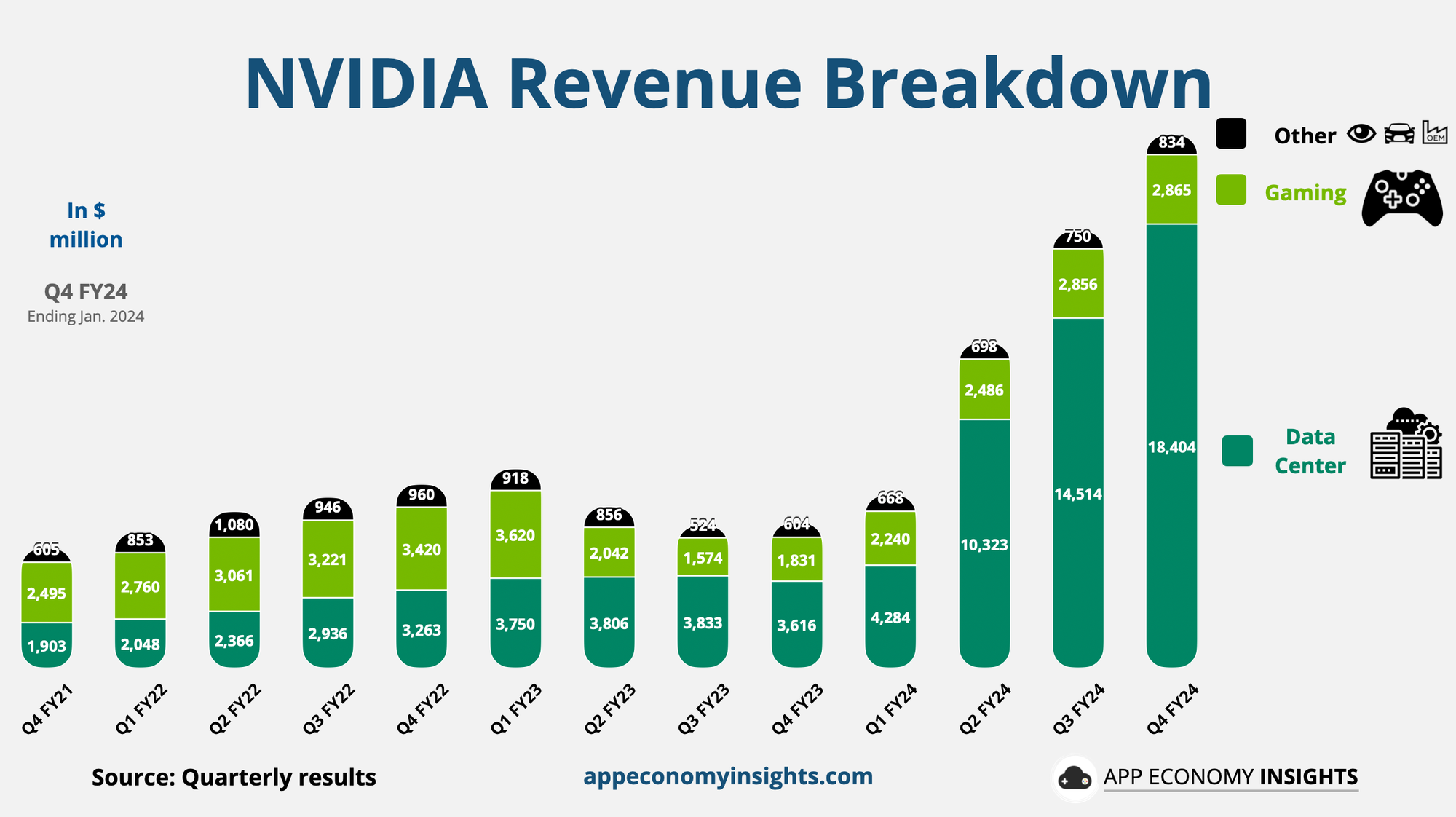

During their quarterly earnings call earlier this week, NVIDIA's CFO, Colette Kress, pinpointed the company's data center growth as being propelled by the demand for generative AI and large language models across a diverse array of industries, use cases, and regions. This growth is underpinned by significant contributions from cloud service providers, including all hyperscalers like Amazon, Microsoft, and Google, with Microsoft's Github Copilot being a standout application. Consumer Internet companies, led by Meta's substantial investment in NVIDIA's H100 GPUs, and a broad enterprise demand across sectors from automotive to healthcare, underscore the widespread adoption of NVIDIA's AI technologies.

The earnings call also highlighted Nvidia's significant strides in software and services, with an annualized revenue run rate of $1 billion. The addition of AWS as a new partner for Nvidia DGX Cloud illustrates the expanding ecosystem Nvidia is building, further cementing its position in the AI landscape.

Rival firms Advanced Micro Devices and Intel aim to loosen NVIDIA's stranglehold on the AI chip market. But analysts say NVIDIA retains key advantages thanks to its head start and sophisticated supporting software. Big tech giants like Meta and Google are stockpiling NVIDIA chips by the tens of thousands to power their AI aspirations.

NVIDIA's business model transformed in recent years alongside its technological focus. In 2019, gaming represented over half its revenues but has since shrunk to just 17%. Meanwhile, its data center/AI division now contributes 78% of total revenues, up from 25% three years ago.

While a lot of resources are being poured into developing ever-larger AI models, deploying them at scale for practical applications requires massive inference capabilities. Importantly, a major chunk (40%) of NVIDIA's Data Center revenue is from inference. This is key as inference represents a much larger market vs training (which NVIDIA is already the market leader in.) Spending on AI inference is growing exponentially alongside the booming adoption of generative AI models. Basically, whenever you interact with an AI tool like ChatGPT, that's an inference handled by NVIDIA's GPU platform.

"The amount of inference that we do is just off the charts now [...] The inference part of our business has grown tremendously. We estimate about 40%," said Huang on NVIDIA's earnings call.

As these models proliferate across the consumer internet, enterprise software platforms, and wider business world, demand for inference hardware like NVIDIA's GPUs is skyrocketing. The company's investments in boosting inference performance while reducing costs has positioned it to capture surging inference spend as AI becomes further embedded into global industry.

At $2 trillion and with triple-digit growth, NVIDIA seems poised to continue its ascent up the market cap charts. Looking ahead, Huang remains optimistic about continued growth, driven by the transition to accelerated computing, the generative AI revolution, and the emergence of new industries.