The Biden administration announced sweeping new restrictions on October 17th aimed at limiting China's progress in advanced semiconductors and artificial intelligence. The rules expand on export controls first imposed in October 2022 and represent the latest move in an escalating tech standoff between the two superpowers.

Under the new regulations, U.S. companies seeking to sell advanced AI chips or manufacturing equipment to China will face expanded licensing requirements. The controls apply not just to final chip products but also to underlying production technology and tools. The U.S. argues this is necessary to prevent China from developing its domestic chip capabilities as well as acquiring chips through third countries.

While the restrictions target technologies with potential military uses like hypersonic missiles and surveillance systems, they could also hobble China's booming commercial AI sector. Chinese firms developing AI applications and services - from chatbots to autonomous vehicles - rely heavily on advanced U.S. and foreign-made chips.

Major U.S. chipmakers like NVIDIA, AMD, and Intel are expected to take a significant revenue hit from the lost sales. However, the administration stated the national security imperative outweighs commercial interests. It remains to be seen whether China can build suitable domestic alternatives or if the restrictions will achieve their goal of slowing China's AI ascent.

Critics argue that such moves might accelerate China's push towards developing its own technologies, thereby diminishing U.S. influence in the long run. While China has made strides in chip technology, it still lags behind the West.

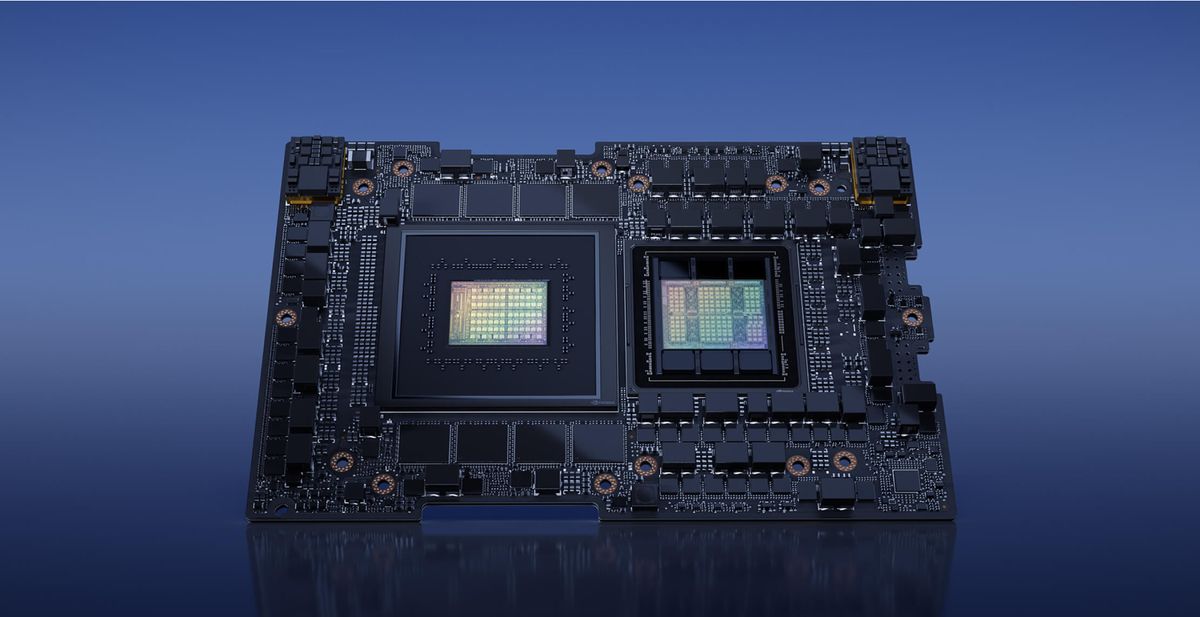

In response to previous restrictions, NVIDIA developed the H800, a less capable chip than their flagship H1oo, for the Chinese market. The new rules will prohibit even the sales of these chips, potentially affecting a sizable chunk of the company's revenue.

However, NVIDIA downplayed the financial implications, with spokesperson Ken Brown stating: "We comply with all applicable regulations while working to provide products that support thousands of applications across many different industries. Given the demand worldwide for our products, we don’t expect a near-term meaningful impact on our financial results."

Tensions are likely to grow as the U.S. doubles down on export controls while trying to boost its own semiconductor production. The latest rules come just ahead of the potential Xi-Biden summit next month. With semiconductor supremacy becoming a key battleground in U.S.-China rivalry, compromise looks increasingly unlikely. For now, the chip wars continue to escalate - with seismic implications for the AI landscape globally.